The theater of exchanges business to business (B2B) it is now increasingly that of the internet.

The digital transition for companies that sell products and services to other companies is a rapidly and continuously expanding phenomenon.

Consider that in Italy, in 2020, the value of transactions carried out in B2B had already reached a value of 406 billion. In 2021, and therefore according to the latest data, there was an increase in 12% and, in currency, a jump to 453 billion euros.

The data, provided by two different studies of the Digital B2B Observatory of the School of Management of the Polytechnic of Milan, therefore speak very clearly. E-commerce, even in B2B, means innovation and the construction of a more advantageous present and a bright future.

The effects and regulatory obligations of the pandemic.

Working through digital tools such as B2B has in fact given those who have decided to invest in B2B the possibility of guaranteeing a certain operational continuity, to minimize the disastrous effects of lockdowns, and to achieve stable turnover or even growth, contrary to what happened with traditional companies.

In fact, for almost half of Italian companies, the health crisis has given a strong boost to the digitalisation of B2B processes, with around one in five companies having invested in digital solutions and the 38.5% planning to introduce tools for Digital B2B within a maximum of two years.

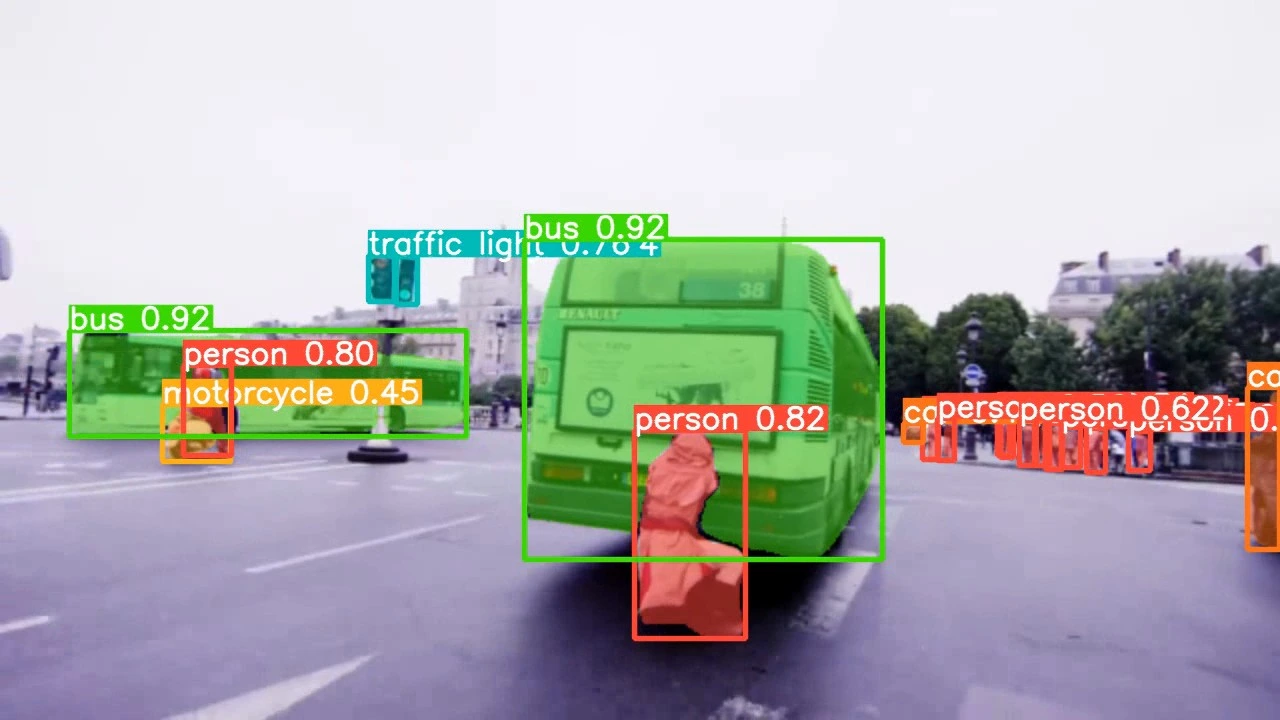

Among these, solutions for process automation (16%), Blockchain and Artificial Intelligence (13,8%) and tools for monitoring the supply chain (13,1%) emerge.

But it is precisely B2B e-commerce that has withstood the brunt of the pandemic the most, reaching, as regards the total value of orders exchanged via digital tools, the aforementioned figure of 406 billion euros.

While B2B transactions therefore suffered a setback (-6%), e-Commerce recorded only a -1%, however its impact on total B2B exchanges increased by 1% compared to 2019, going from 19% to 20% .

The further leap forward occurred, as mentioned, last year, during which the specific weight on the entire range of B2B exchanges went from 20% to 21%, equal to increase of 47 billion euros.

Among the most digitalised sectors, consumer goods, automotive and pharmaceuticals stand out and, to offer some data on trade outside national borders, digital transactions between Italian and foreign companies are worth 127 billion euros, equal to 29% of total B2B abroad, with automotive as the first sector, followed by textiles-clothing and mechanics.

According to the latest data, ultimately, i B2B portals have already been activated by the 13% of the Italian companies and the 12% of the Italian companies has its own site which functions as a showcase and a shop; in short, customers can view or purchase products as previously only happened from a business to consumer perspective.

Electronic Data Interchange (EDI)

L'AND OF, electronic data interchange, confirms itself as a leading technology for the structured exchange of information in the B2B sector, even if its growth slows down due to the entry of other solutions to support processes between private individuals.

In 2021, again according to data from the Digital B2B Observatory of the School of Management of the Polytechnic of Milan, there would have been 21 thousand companies have adopted Electronic Data Interchange, exchanging a total of 262 million documents between them.

We are talking, in detail, about a good +5% of companies compared to 2020 and a +4% compared to documents exchanged, again compared with the previous year.

The greatest growth recorded among the documents exchanged was then found in three specific categories: – the order;

- the order confirmation;

- the shipping notice.

Furthermore, between 2020 and 2021, via transactions also grew B2B marketplaces, with a +50% compared to 2020, as well as the importance of B2B portals which, activated by the 13% of Italian companies, now act as real hubs, through which all the documents of the executive cycle flow.

The Blockchain

In terms of the use of blockchain and distributed ledger technologies, to support relationship processes between customer and supplier, our country still lags behind, with recorded use still sporadic.

In fact, the data tells of a 96% of companies that have not yet started projects, despite the creation of B2B ecosystems is also being structured on the basis of these technologies.

However, a good 14% has already declared the start, or intention to start, projects during 2022, which will therefore focus on product traceability, exchange of documents in digital format and management of internal data.

The new B2B trends

It is theoptimization of the relationship with the business customer, especially following the pandemic and the ever-increasing interest in the valorization of company data, to have become one of the most evident trends at B2B level.

A trend that can therefore translate into a real need but which, despite everything, is not yet turning into effective action.

Most Italian companies limit themselves to exchanging technical or commercial information, demonstrating a degree of foresight that is still too low.

Only one in five, therefore just 20% of the companies spread across the national territory, would have activated a collaboration with their customers for the exchange of strategic information. This is what the data tells us, showing a picture that still reveals a certain immaturity.

However, the same study by the Polytechnic of Milan, examined here, would give an explanation: the delay would derive from a process still in progress within companies, both at an organizational and technological level. In fact, only the 34% of Italian companies records full integration between the various company functions that have contact with the customer, while still only the 39% has a technological infrastructure capable of integrating the data present in various databases.

However, the culprit data is another: as soon as 15% of Italian companies moved with investments and projects that point in both directions and to fill the deficit.